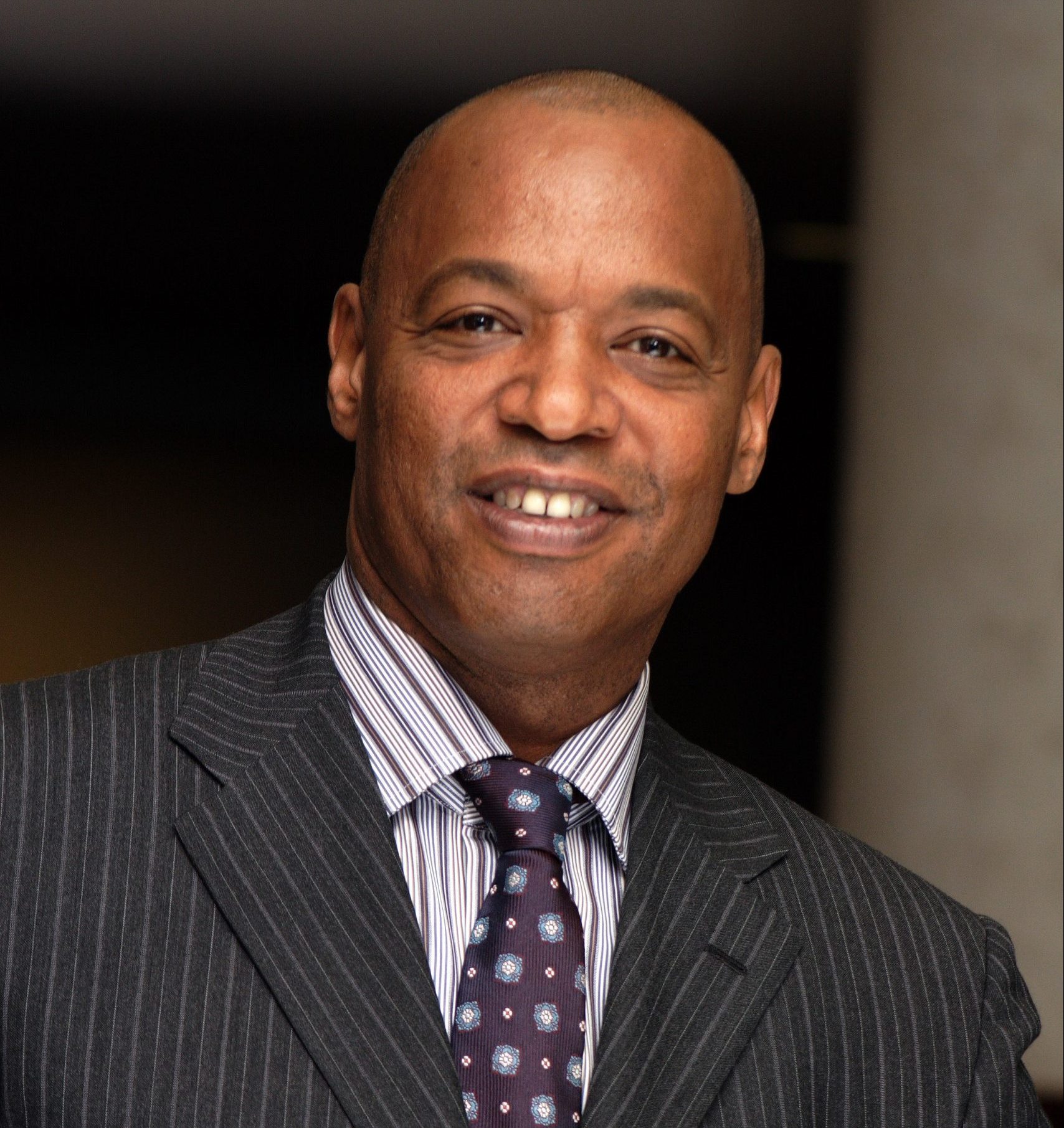

Kevin Cohee is one of the country’s most brightest minds. He’s a banker and owner of OneUnited Bank. He’s also the Chairman and Chief Executive Officer of this historical financial institution. His leadership has brought much success to his organization. With a unique strategy to unify several black banks (Founders National Bank, Family Savings Bank, People National Bank and Boston Bank of Commerce), the bank has over $650 million in assets.

Kevin Cohee started in the financial industry in 1979. At that time, he founded a consulting firm that specialized in acquisition of radio and television stations. His extraordinary ability to visualize an idea and make it an reality has been noteworthy. The financial mogul sat down with Industry Rules to discuss his profession and some insight on his success.

AF: What was the inspiration in creating OneUnited Bank?

KC: As a child of the Black Panther Movement I was motivated and inspired to make the well-being of Black America the essence of who I am. OneUnited Bank is designed to help Black America build the economic infrastructure necessary to obtain political, social, and economic power within American society. The end goal is to ensure that Black Americans not only survive but thrive in this country.

AF: With OneUnited Bank being the largest Black owned bank and the first Black owned internet back in America, what were some of the challenges you faced in building this financial conglomerate?

KC: To obtain a FDIC insured Bank charter, which requires substantial capital and expertise.

• Building a management team with the wide range of expertise necessary to develop the products and to operate a technologically driven, nationwide business that processes billions of dollars in transactions and conducts “face forward” operations.

AF: OneUnited Bank’s increased from $56 million to over $650 million dollars since 1996. What attributed to this significant growth?

KC: OneUnited Bank’s products and services, financial literacy training, and Black community activism provides Black Americans and their allies with an opportunity to have first class, technologically sophisticated, and fashionable financial products. These products are designed to support todays “on-the-go” lifestyle where customers need:

• Access to their accounts through their telephone and computer (Mobile Banking)

• Sending and receiving money through apps like Cash App, Venmo, Zelle

• CardSwap, which allows you to track monthly expenses like Netflix, Uber, Apple, etc.

• Getting their Paychecks 2 days earlier than other banks

• Debit cards that look amazing and communicate our values to the world

AF: Can you explain the Bank Black movement and its importance?

KC: OneUnited Bank is designed to empower Black America by garnering the spending power of Black Americans and re-channeling it back into our communities to create positive social change. The concept is rooted in using the power of money; spending money with corporations and government entities that act in ways beneficial to Black Americans and not spending money with corporations that do not act in the interest of the Black Community.

OneUnited Bank is constantly involved in social activism on behalf of Black America, providing leadership and financial support. Blackout Day 2020 is a current example of the Banks’ activism.

AF: With the world now listening about the social injustice happening against people of color throughout the United States, what practice(s) would you like to see reformed within the banking industry?

KC: Banks need to recognize that systemic racism is a real thing and that they need to provide better access to loans and investments to the Black Community.

Bank regulators need to implement FIRREA Section 308 in a serious manner that is consistent with the goals of that statute to serve and promote the growth of Minority Depository Institutions. Through the decades the statute has been in existence, regulators have “managed” the statute, but have not implemented the statute as it was intended.

In addition, the current CRA statute, while well intended, has damaged Black-Owned banks by causing undue concentration risk in its lending and overall Banking operations and needs to be reformed.

The time for change has never been better with Jelena McWilliams at the helm of the FDIC. She has been committed to creating a positive regulatory environment for MDI’s.

AF: What advice would you give to a young black adult who’s looking to start his/her career within the finance industry?

KC: Whatever industry you enter, make sure that you develop the ability to sell products and services using the internet. One of the lessons COVID-19 taught us is that the more essential the service you provide and the better that service is integrated into technology, the more viable the company is. The internet and other technologies are not going away and it creates the best money-making environment ever.

AF: How is OneUnited Bank helping their customers navigate the economic impact of the COVID-19 pandemic?

KC: We are working to make Financial Literacy a core value of the Black community:

• We are supporting social justice movements including Black Lives Matter, The Take a Knee Campaign, Blackout Day 2020, and The 1619 Project, because public policy is needed to address economic inequality.

• Created an operation to do PPP loans.

• More than doubled the size of our customer service operation.

• Doubled the size of our social media operation.

• Expanded our marketing and lending operations.

AF: What’s next for OneUnited Bank?

KC: Carpe Diem, for Black people and our communities.

For information on OneUnited Back, please visit their website and social media handle, @OneUnited.

Photo by OneUnited Bank